By Bret Swango, CFA and Monty Turner

In this new blog series, Colliers Industrial and Occupier Services team members from across the organization offer their expertise into the factors driving onshoring, the impact on industrial real estate, and key takeaways for investors and occupiers alike. Click here to read Part 1.

The global risk environment has changed dramatically in the last 18 months creating a dynamic operational and regulatory landscape and driving a surge of onshoring activity. In turn, the resurgence of American manufacturing aided by a flurry of new incentive packages is propelling clean energy and domestic security initiatives forward. However, this trend presents its own challenges, such as labor shortages and the requirement for significant infrastructure investments.

This blog post examines the factors advancing the green transition and explores some of the opportunities and trials coupled with this transformation.

Factors Driving Onshoring

The last 36 months have driven a recalibration of many organizations’ risk and return profiles. It’s the job of corporate leaders to reduce risk and maximize returns, and the pursuit of these objectives has fueled the wave of onshoring activity.

When risks aren’t baring their head, companies prioritize returns and “efficiency”, which often meant offshoring manufacturing to lower-cost operating environments abroad. This efficiency, however, translated to fragility, as demonstrated by the immense supply chain disruptions caused by the COVID-19 pandemic and widespread geopolitical unrest.

The cost of production has become another driver of onshoring expansion. COVID-related supply chain disruptions caused container shipping costs to spike in excess of 10x to some parts of the world, leading to a demand for proximity to the consumer in order to mitigate potential future cost spikes. Additionally, continued advancements in manufacturing practices have shifted the production profile to be more dependent on highly technical, energy-intensive practices, reducing the low-skill labor component of the cost equation and increasing the significance of power. Given that the U.S. is one of the cheapest global producers of energy, it has benefited from this transition.

Shift Toward Green Energy

As corporations prioritize risk-adjusted returns, the turn towards green manufacturing and onshoring is becoming increasingly relevant. Recent trade policies and incentives have been put in place to promote the transition from fossil fuels to clean energy.

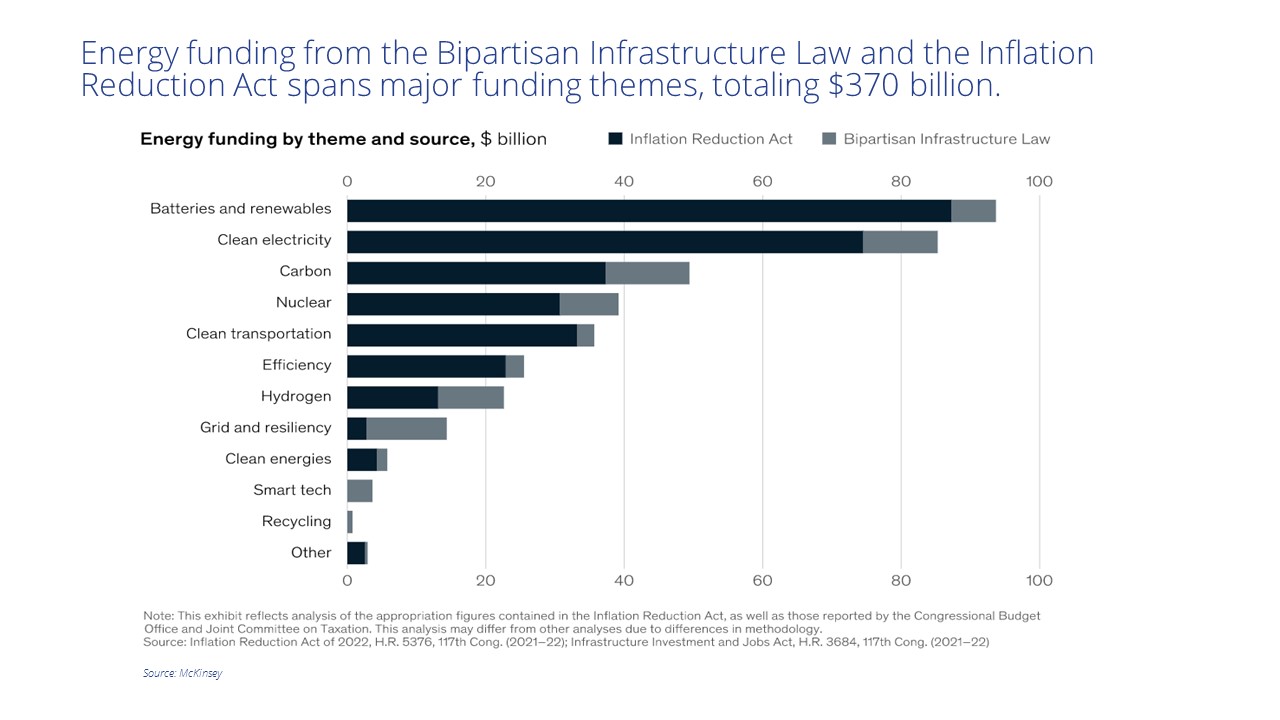

The U.S. has committed nearly $400 billion between the Bipartisan Infrastructure Legislation (BIL) and the inflation reduction act (IRA) to clean energy, resulting in a resurgence of capital spending in the U.S., with a particular focus on EVs, EV batteries, solar, and other key components of the green transition. See Chart 1 below.

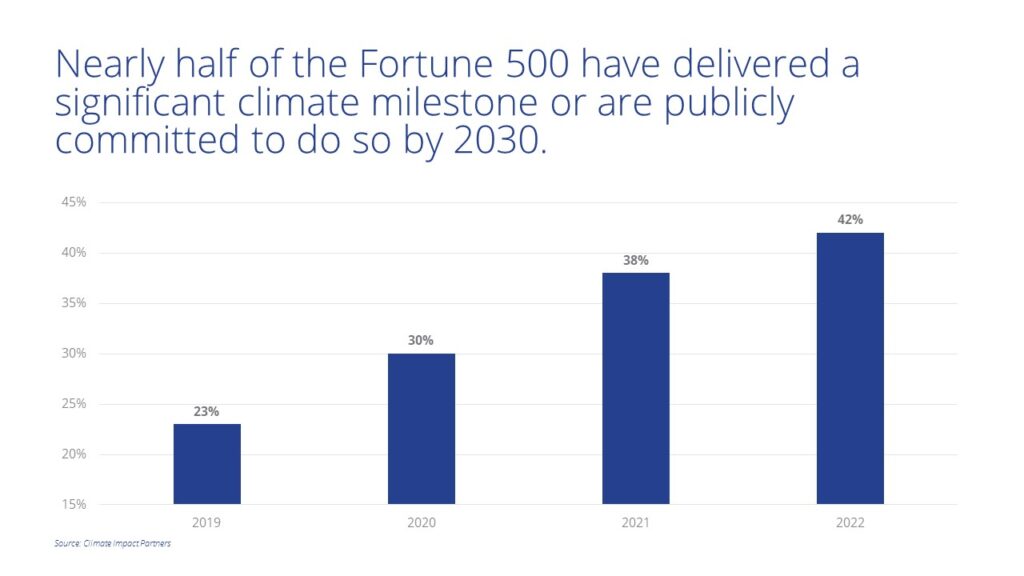

Corporate tailwinds have also led to a significant milestone in the transition to clean energy. Over 42% of the Fortune 500 have committed to delivering or are publicly committed to a significant climate milestone by 2030, a figure that has almost doubled from 23% in 2019 (see chart 2 below). Production closer to consumers has aided the push for green manufacturing, reducing the carbon impact of transporting goods from production to consumption.

New Manufacturing Boom Exacerbates Labor Shortage

In the last two years, the U.S. has seen over 50 manufacturing project announcements worth at least a billion dollars each, surpassing the total number of similar announcements made in the previous decade, according to FDI market intelligence. Nearly half of these projects are for semiconductors and electrical components. This is a dramatic turnaround from the almost five million manufacturing jobs lost over the first two decades of the 2000s and equates to a net addition of 128,000 jobs in 2022 according to the Bureau of Labor Statistics.

Labor remains a significant concern for CEOs, with labor costs and availability ranking as top site selection factors in Area Development’s 2022 survey. The current manufacturing renaissance has resulted in significant shortages of trades and engineering talent required to operate and construct these new facilities as tradesmen in the U.S. are aging into retirement without a younger cohort of talent to replace them. For example, 55% of electricians are over the age of 40, more than three times the percentage of white-collar labor segments such as accountants or software engineers.

Incentives Implications

Among the factors influencing onshoring decisions, government incentives emerged as the most cited variable, followed by the availability of a skilled workforce and supply chain, natural disaster, and geopolitical risks, per Reshore Now.

Many states are enhancing their competitiveness for both mega and traditional projects by establishing separate funds for mega-project incentives. Ohio and Georgia’s early acquisition of sites and their readiness have paid off with the site shortage benefitting them. Their preparedness has increased their appeal to prospective users, with speed to market becoming increasingly critical for firms chasing IRA dollars and tighter ROI timeframes.

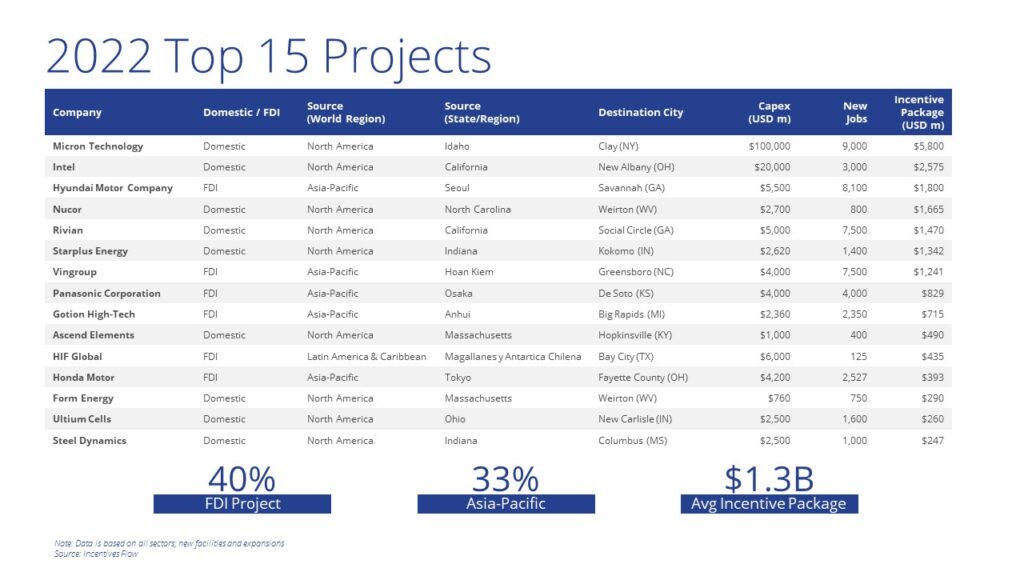

As onshoring projects and mega projects continue to flow, incentives have become a battleground among communities, states, and regions to secure transformational projects. The top 15 incentive projects of 2022 (see chart 3 below) reflect where these projects are coming from and the top industries driving them. Asia-Pacific countries lead the way from an FDI perspective with automotive, semiconductors, and metal industries at the forefront of industries making trajectory shifting investments in communities and states.

Stay tuned for the next article in our blog series featuring the benefits of onshoring. Subscribe to Knowledge Leader to receive updates on the next article in this series.

About the authors

Bret Swango, CFA

As a Senior Vice President of Location Strategy & Workforce Analytics, Occupier Services, Bret Swango leads the day-to-day consulting operations of this service offering. An industry expert in labor and location related data analytics, he provides clients with data-driven insights on markets around the world to help them make informed location selection decisions.

Monty Turner

As Senior Vice President, Monty serves as Chair of Colliers’ Economic Incentives practice group and helps lead Colliers’ national site selection and incentive negotiation services business line – guiding clients looking to invest in new expansions or relocation alternatives. As the facilitator of Colliers’ proprietary site selection modeling tool, Indsite®, Monty executes multi-state corporate location decisions through consulting engagements focused on labor analytics, utility infrastructure, logistics, taxes, environmental considerations, economic incentives and overall business climate.

Bret Swango, CFA

Bret Swango, CFA

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett