Last week, Q3 GDP growth was revised upward, from its outsized 4.9% growth rate to an even stronger 5.2%. Consumer spending and an increase in both inventory and government spending were the primary drivers of growth last quarter. However, with all three drivers projected to decline over the short run, Q3 growth will be as good as it gets for a while. Oxford Economics is projecting that GDP during the first two quarters of 2024 will be flat, followed by a mild uptick during the year’s second half. Because of the year’s sluggish start, Oxford anticipates GDP growth of just 0.2% in 2024, followed by 1.6% growth in 2025.

Recent CPI, PCE, and unemployment data support the Fed’s growing confidence that its restrictive monetary policy is feeding through the economy; however, despite signs of inflationary easing, the Fed continues to maintain its “higher for longer” stance.

“I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.” – Governor Christopher J. Waller in a speech.

At its September 2023 meeting, the Fed indicated it doesn’t anticipate inflation returning to the 2% target for some time. The notes from the meeting stated it is projecting that the Core PCE Price Index will end 2024 at 2.6%, followed by an additional 30-basis-point decrease in 2025.

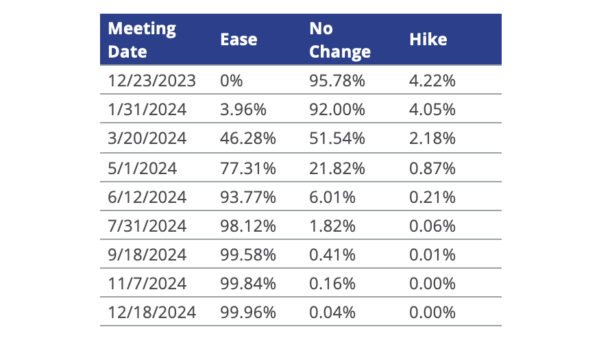

Because of the higher-for-longer mantra, the meeting notes accounted for an additional 25-basis-point rate hike this year, bringing the benchmark overnight interest rate to 5.50%–5.75%. However, the CME FedWatch Tool predicts a less than 5% chance that the Fed will go forward with one last rate increase at its December 13th meeting.

While most economists agree that the economy is cooling, according to a recent Bloomberg survey, many, like the Fed, feel that inflation will recede slowly in 2024, leading the Fed to keep rates higher through the end of 2025. The survey predicts that the first rate cut will begin in the middle of 2024.

On the other hand, Wall Street appears to be more bullish than the Fed, based on recent Treasury-rate movement, and expects rate cuts to begin sooner. The CME FedWatch Tool foresees a probability of the first cut at 46% by March 20, 2024, 77% by the May 1 meeting, and just under 94% by the June 12 meeting.

Steig Seaward

Steig Seaward

Aaron Jodka

Aaron Jodka