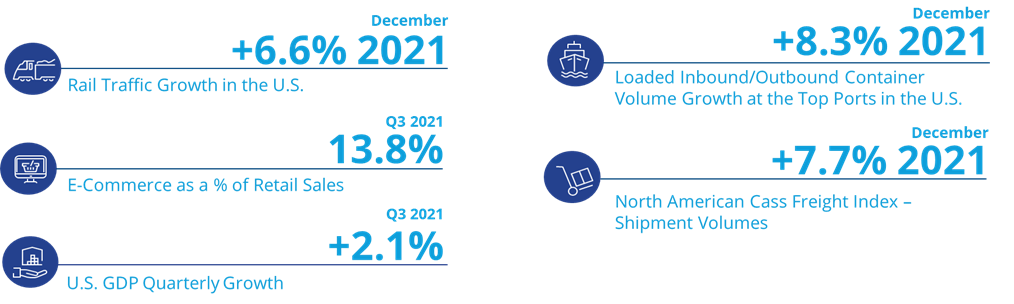

The U.S. economy continued to grow throughout 2021, although at a much slower pace in the year’s final quarter. The surge in COVID-19’s Omicron variant remains a concern, although the number of vaccinated Americans has risen to more than 64%. Consumer behaviors continue to trend towards more frequent brick-and-mortar sales; however, online ordering is still common for many consumer products. This should continue to drive demand for warehouse and distribution space to new and emerging markets across the country.

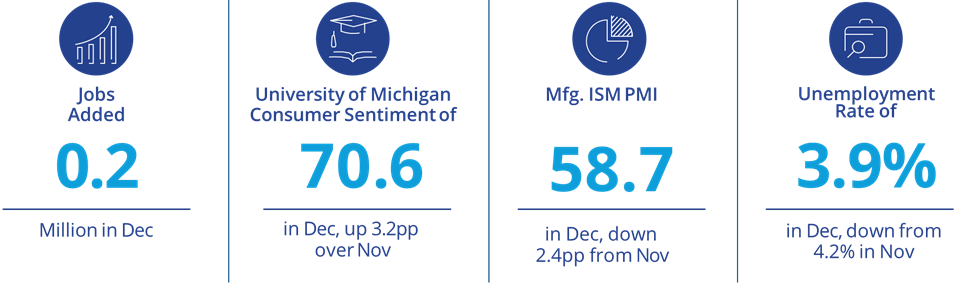

U.S. employment continued to improve and reached a pandemic-era low of 3.9%, edging closer to the 50-year low of 3.5% last reached in February 2020. According to the Bureau of Labor Statistics, the economy added another 199,000 jobs in December, a decrease of 2.8 percentage points from this time last year; however, job growth averaged 537,000 per month in 2021. Employment growth in December included notable job gains in office-using segments, including leisure and hospitality, and professional and business services. Other sectors directly impacting the industrial market also showed positive momentum, however at a much slower pace, as job gains were also seen in manufacturing (+26,000), construction (+22,000) and transportation and warehousing (+19,000).

In December, consumer sentiment rose month-over-month as consumer attitudes improved through the holiday season. According to the University of Michigan Consumer Sentiment Index, the Delta and Omicron variants were largely responsible for the 17.7 percentage point drop since the high of 88.3 in April 2021, but other factors, some of which were initially triggered by covid, have become independent forces shaping sentiment. While supply chains and essential workers have sparked the initial increases in prices and wages, a wage-price spiral that has subsequently developed is no longer tied to those precipitating conditions. Consumer sentiment measured 70.6 in December, down considerably from 79.0 at the beginning of the year.

The retail industry took an unexpected deep hit at the end of 2021 due to multiple factors, including, but not limited to, supply chain challenges and labor shortages. Despite these concerns, year-over-year U.S. retail sales increased 16.9% in 2021, yet U.S. retail sales fell 1.9% from November 2021. Restaurant and bar sales had the highest annual percentage gain at 41.3%, followed by gas station sales rising by 41%. According to the National Retail Federation, inflation spikes in the spring, if enacted, could cause further concerns heading into 2022.

Although at a slower pace than earlier in the year, manufacturing production continues to grow, recording growth for the twentieth consecutive month. The Institute for Supply Chain Management’s Production Manufacturing Index (PMI) registered 58.7 in December, down 2.4 percentage points from November’s reading of 61.1. Shortages of critical lowest-tier materials, high commodity prices and difficulties in transporting products continue to plague reliable consumption and continue to affect all segments of the manufacturing economy. Nevertheless, the outlook for manufacturing remains optimistic, yet labor shortages and supply chain challenges continue to stifle strong sector expansion.

Overall, while still positive, these economic readings could signal a general slowdown of expansion that is more due to staffing shortages and rising costs than a decrease in demand. Nevertheless, the outlook for 2022 remains positive and demand for goods remains high, which in turn leads to strong market fundamentals that impact industrial real estate. The U.S. industrial market was one of the strongest real estate sectors for the last two years, and that is not expected to change in 2022.

U.S. National Research

U.S. National Research

Steig Seaward

Steig Seaward

Aaron Jodka

Aaron Jodka