While the latest economic indicators for June were mostly positive, the readings did not show significant growth. Many economists are expecting a mild recession – a period of negative GDP, rising levels of unemployment, and falling retail sales – in the near future, and the Federal Reserve is attempting to bring inflation under control by continuing to raise interest rates. The Fed lifted interest rates for the third time this year in June by 75 basis points, the largest increase since 1994, and is expected to do it again in July.

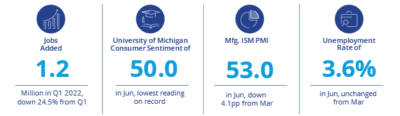

The threat of a potential economic slowdown will manifest as a headwind for the industrial market for at least the next few quarters. The U.S. economy continues to add jobs, although not at the pace of 2021. Job growth slowed a bit in the second quarter, with 1.2 million new jobs added to the U.S. economy, compared to 1.6 million positions created during the first three months of the year, according to the latest jobs report from the Bureau of Labor Statistics. The unemployment rate has remained unchanged at 3.6% for four consecutive months. Month-over-month notable job gains continued in professional and business services (+74,000), leisure and hospitality (+67,000), health care (+57,000) and transportation and warehousing (+36,000). Other sectors directly impacting the industrial market also showed positive momentum as job gains were seen in manufacturing (+29,000), and wholesale trade (+16,000). Construction and retail trade showed little change.

Consumer sentiment continues to slip as declines have been recorded for the second consecutive month. According to the University of Michigan Consumer Sentiment Index, the consumer sentiment index reached 50.2 in June – its lowest recorded value since the inception of the index in the 1970s. Increased fuel costs and inflation are undoubtedly the greatest sources of uncertainty affecting consumer sentiment, and consumer spending is expected to slow as a result. As these economic concerns are not expected to shift considerably in the coming months, expect consumer sentiment to remain relatively weak.

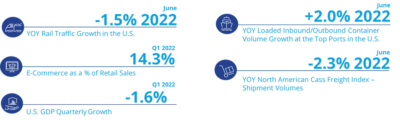

As the impacts of inflation continue to reach consumers, American retail spending rose just 1% in June – slightly better than the predicted 0.9% gain. The same catalysts responsible for the dip in consumer sentiment are some of the same reasons retail spending was elevated. Steeper prices for goods, groceries, and gas, up roughly 9% over the past year, signify more of a leveling off in spending, rather than an increase in spending. According to the U.S. Department of Commerce, e-commerce accounted for a total of 14.3% in the first quarter of 2022 (the latest data available at the time of this article), down from the 13.2% recorded in the previous quarter.

Economic activity in the manufacturing sector grew in March, with the overall economy achieving 25 consecutive months of growth, according to the Institute for Supply Chain Management’s Production Manufacturing Index (PMI). June PMI registered 53.0, which, while still positive, is 3.1 percentage points below May’s reading of 56.1. This represents the lowest PMI reading since June 2020, when it registered at 52.4. Nevertheless, the manufacturing sector hopes to maintain the momentum its sustained since 2020, and more conversation has revolved around reshoring manufacturing production to the U.S. While this remains a costly endeavor, rising transportation costs – which account for a bulk of supply chain expenses – are top of mind when relocating manufacturing facilities. ISM also reported that 15 of the 18 manufacturing sectors it tracks saw growth in March. The three industries that contracted were paper products, wood products and furniture and related products.

While most economic readings remain relatively positive, it is clear that an economic slowdown is becoming more of a reality. The overall picture for industrial remains bright, yet these headwinds could be a cause for concern for the remainder of 2022. Supply chain challenges persist, with labor contracts and strikes at ports exacerbating the concerns. Industrial occupiers are focused on getting products in the hands of consumers sooner, and supply chain delays are making that more difficult. The good news is, increasing rates have not curbed industrial occupancies, and year-over-year industrial investment sales increased by 35%. Higher interest rates could increase finance costs, however, which may decelerate investment activity in the sector. Overall, industrial fundamentals, including occupancy gains and rent growth, remain positive, which should keep the industrial development pipeline full. The U.S. industrial market is expected to ride this new wave with the strength it demonstrated over the last two years.

U.S. National Research

U.S. National Research

Steig Seaward

Steig Seaward

Aaron Jodka

Aaron Jodka