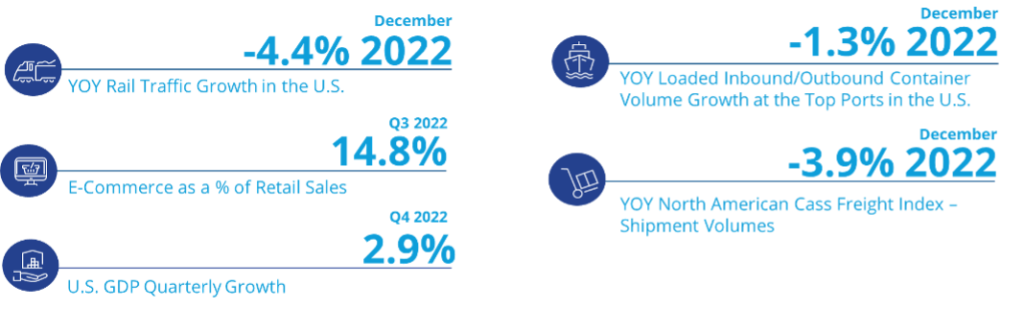

Talk of a recession has persisted for months now. While most economists predict that the U.S. will enter a recession in 2023, few can agree on when. However, some of the latest economic indicators at the end of the year continued to show signs of growth, like consumer sentiment and GDP, while others, like consumer sentiment and manufacturing PMI continued to fall. The annual CPI inflation rate fell for the sixth month, to 6.5%, from 7.1% in December, marking the lowest level in more than a year and down from a 40-year peak of 9.1% last summer. According to the Fed’s median projection in December, its key benchmark borrowing rate is projected to rise another three-quarters of a percentage point in 2023. Baseline projections lean towards raising the rate to a 17-year high of 5%–5.25% from its current 4.25%–4.5%. The good news is that even if inflation reaches the Fed’s highest forecasts, the downside scenario would raise rates by 1.25 percentage points for 2023, a far cry from the 4.25 percentage points of tightening the Fed approved in 2022. A possible recession remains a serious concern for the U.S., but optimistically, it could be shallow and short.

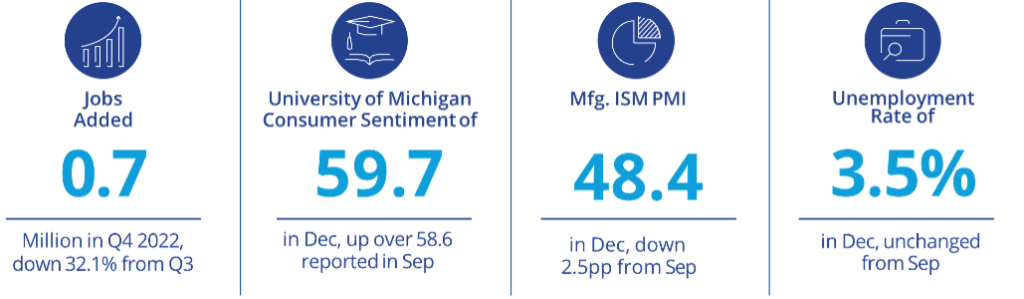

The U.S. economy continued to add jobs in 2022, 4.4 million, following 6.7 million added in 2021 — a strong recovery from the 9.2 million jobs lost in 2020. However, according to the latest jobs report from the Bureau of Labor Statistics, job growth slowed in the fourth quarter of 2022, for the second consecutive quarter, to 700,000 new jobs added after 1.1 million were created during the third quarter. In addition, the unemployment rate has hovered between 3.5% and 3.7% since March 2022. Month-over-month notable job gains continued in December in leisure and hospitality (+67,000), healthcare (+55,000), and construction (+28,000). Sectors directly impacting the industrial market also improved to some extent, as employment grew in retail trade (+9,000), manufacturing (+8,000), and transportation and warehousing (+5,000). On the other hand, wholesale trade employment showed little change.

Consumer sentiment is beginning to improve. The University of Michigan Consumer Sentiment Index reached 59.7 in December, indicating lower negative perceptions as inflationary pressures are mitigated. Economic uncertainty seems to be the primary reason, however, for the current recording measuring 15% below that last year at the same time. While consumer sentiment has lifted from its historical low of 50.0 in June, its future trajectory hinges on the strength of the labor market.

According to the Institute for Supply Chain Management’s Production Manufacturing Index (PMI), economic activity in the manufacturing sector fell at year-end to below the growth benchmark of 50.0 for the second consecutive month. December PMI of 48.4 was the lowest reading in 2022 and the lowest since May 2020, when the index was 43.5. This contraction comes as consumers shift their spending away from goods to services and entertainment. ISM reported that only four of the 18 manufacturing industries it tracks grew production in December: primary metals; electrical equipment, appliances, and components; transportation equipment; and machinery. The eight industries that contracted in December from November are chemical, wood, and paper products; fabricated metal and furniture and related products; plastics and rubber products; and miscellaneous manufacturing and computer and electronic products. Six industries reported no change in production.

While these economic indicators like PMI and consumer sentiment are concerns for the industrial sector, industrial fundamentals remained favorable at year-end, marked by fewer port backlogs (port congestion was down 60% year-over-year), falling ocean and trucking carrier costs, and increased capital for infrastructure projects. However, even as supply chain pressures ease, the U.S. industrial real estate market remains extremely tight. Fifteen industrial markets maintained sub-2% vacancy, including emerging markets like Las Vegas, Savannah, Norfolk, Charleston, and Nashville. Further, the industrial pipeline remains incredibly full, with nearly 650 million square feet under development. This much-needed space should satisfy occupier demand in expanded territories, and overall, the positive momentum in the industrial sector should bode well for leasing in 2023.

U.S. National Research

U.S. National Research

Steig Seaward

Steig Seaward

Aaron Jodka

Aaron Jodka